Has the Property Market Peaked? Should you buy now or wait for the bargains…

• Many commentators believe we have seen the peak of the property market.

• So, should savvy bargain hunters wait for house prices to fall?

• Or could postponing your house buying for any anticipated house price drop be a costly mistake?

Over the last two years, the property market has been a rollercoaster ride of hyperactive demand together with the new sport of getting your offer accepted when you compete with 30 other bidders.

There are clouds on the horizon that the property market could be at its peak

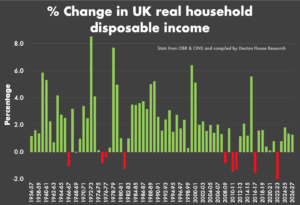

Bank of England interest rates have increased four times in the last few months to try and combat inflation. Meanwhile many households are finding it tough to counter the most significant drop in real incomes in a single year since records began in the mid-1950s, all at the same time as gas, heating oil and electricity prices are predicted to rise again in the autumn.

Hence why some economists are predicting house price drops in the coming 18 to 24 months of 3% to 5%.

So, surely this is not the best time to buy a property – and surely savvy buyers should wait for house values to fall?

Is it realistic to see double-digit national house price growth? Certainly not.

The question is how far the property market will slow and whether the slowing will drop into modest falls.

Lets look at household income first

At best, the outlook is gloomy as real household disposable income is set to drop by 2.4% in 2022/23, the largest drop since records began in 1956. This is despite the £17.6 billion of financial support for British households revealed in Rishi Sunak’s Spring 2022 Statement with the National Insurance thresholds, energy bill support package and duty cut on petrol. Without these changes announced by the Chancellor, real household disposable income would have fallen by an additional 1% in 2022/23.

Second, as interest rates increase, mortgage rates will increase in line, increasing mortgage costs, so surely that will curtail demand, meaning house prices will drop, and buyers should wait to catch a bargain?

Finally, with inflation on the rise, the real value of people’s savings will decrease quicker, and the value of their deposits will diminish, meaning prices will surely drop, and people should wait to buy?

Should buyers wait for the bargains?

We believe, subject to no significant shocks in the world economy, house price growth will be very slow in the next 18/24 months and go into low single digits (even the odd month dipping ever so slightly into the red), but not the 16% to 19% annual drop we saw in 2008/9.

Lets look at real household income. Every economist predicts growth in real household income in 2023/24 by around 1%.

If the two years are combined, the predicted effect on real household income in the next two years (2022/23/24) is a net loss of 1.4%, whilst in the credit crunch years 2010/11/12, the net loss was 2.7%.

Looking at the increase in mortgage rates: 79% of owner-occupiers have fixed their mortgage costs and had their affordability stress-tested to Bank of England interest rates of 3% to 4% under the Mortgage Market Review rule changes in 2014. We believe the most significant impact of increasing interest rates will be at the point of taking on a new mortgage by first-time buyers (as opposed to servicing or the porting of an existing mortgage from one house to the next house).

The four successive Bank of England base rate rises, inflation and the rising cost of living are likely to bring more cautiousness over summer and autumn when it comes to people buying a property. Yet, there is still a massive imbalance of demand for property over the number of properties for sale to quench that demand.

The potency of the job market and the ongoing mismatch between the supply of properties (mentioned in last week’s article on the property market) on the market and demand for those properties will support property values.

Finally, the by-product of increasing inflation is that it makes buy-to-let more attractive. If there is a reduction in first-time buyers, this will be counterweighted by more landlords buying again, supporting the current level of properties.

But what if house prices do drop significantly?

So let’s assume that house prices do fall, irrespective of the reasons above, it will not inevitably help buyers.

If we have a house price crash, people tend to find their careers are at risk, and their salaries don’t rise as much. The younger generation (i.e. first-time buyers age range) often gets hit the toughest by recessions.

If first-time buyers wait until 2024 to buy and property values drop by 10%, that will prove more expensive.

In the last 2008/09 crash, lenders weren’t offering 5% deposit mortgages. The lowest deposit mortgage that first-time buyers could get was with a 10% deposit and even then, they were hard to come by.

When writing this article, first-time buyers can obtain a 5% deposit mortgage for a fixed rate of 2.66% for five years.

The typical first-time buyer terraced house sells for £252,900.

So, if they were to buy now, on this mortgage deal, the first-time buyer would have to stump up a £12,645 deposit and their mortgage payments would be £879.64 per month.

Yet, let’s say property values in do drop by 10% in the next 18 months, the terraced house would now be worth £227,610, so a significant saving. Or is it?

Everyone believes interest rates will rise further, so let’s assume they go to 3% by the autumn of 2023. That means the mortgage rate for a 10% deposit mortgage will be in the early 5%’s, so 5.29% (because the banks tend to increase the gap between the base rate and the mortgage rate in recessions to allow for the extra risk).

The monthly mortgage payment on the 5.29% mortgage would be £1,072.04 per month, and you would need to double your deposit to £22,761.

So even if house prices did drop by 10%, the first-time buyer would be £2,310 worse off a year in mortgage payments and would have to find double the deposit.

…and then there is the other cost of waiting.

You have two years’ worth of rent to pay.

If you waited a couple of years for house prices to drop by 10%, you would spend £000’s in rent.

Choosing to buy a property makes even more economic sense if it is a long-term choice, as homeowners can ride out any house price drops.

Homeowners who plan to stay in a property can generally rely on getting their money back within six to ten years whilst not paying any rent.

Will prices go up, or will they go down?

Remember, George Osbourne said house prices would drop by 18% in May 2016 if we voted to leave the EU, whilst many economists said they would drop by 5% to 10% when Covid hit in March 2020.

And we all know what happened.

If you think you will be better off owning your own home rather than renting one, don’t bother to wait for the suggested house price drop that may never happen.

If you’d like to find out more, contact your local estate agent team today!